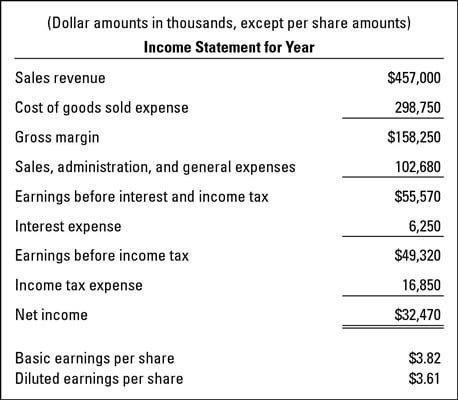

read more, and the same can also be calculated by subtracting the COGS, which is the cost of goods sold Cost Of Goods Sold The Cost of Goods Sold (COGS) is the cumulative total of direct costs incurred for the goods or services sold, including direct expenses like raw material, direct labour cost and other direct costs. One can find a Gross profit figure on the firm’s profit and loss statement Firm's Profit And Loss Statement The profit and loss statement is a financial report that summarizes the company's revenues and expenses over a period of time to determine profit or loss for that period.

read more is the profit that the business makes by selling its goods to its consumers after deducting the costs associated with it while making those products or the costs associated while providing those services. from the direct income generated from the sale of its goods and services. the profit of the company that is arrived after deducting all the direct expenses like raw material cost, labor cost, etc. Gross profit Gross Profit Gross Profit shows the earnings of the business entity from its core business activity i.e. If the investor sold it right when the 10-day line crossed under the 20-day line, they would’ve exited their position before a couple of months of an overall downtrend.The gross profit formula is calculated by subtracting the cost of goods sold from the net sales, where Net Sales are calculated by subtracting all the sales returns, discounts, and the allowances from the Gross Sales, and the Cost Of Goods Sold (COGS) is calculated by subtracting the closing stock from the sum of opening stock and the Purchases Made During the Period. When the 10-day line first crossed above the 20-day line, an investor who bought the stock would ideally capitalize on a two-month upwards trend. For shorter-term investors, the 10-day and 20-day SMAs are often used as well.Ībove, we are looking at Amazon again with 10-day (purple) and 20-day (green) SMA lines. The most popular moving averages for longer-term investors are the 50-day and 200-day SMAs. Looking at when the lines cross over, it helps certain traders time their trades. The strategy is done by plotting two SMA lines based on two different time frames.

SMA crossover strategy is another technical strategy used for entering and closing trades.

However, investors must be careful when trying to time the intersections, as the SMA is based on historical information and lags behind real-time data. It may sometimes be a good indicator to sell. However, when the price intersects and falls below the SMA line, we see a downtrend in prices for a bit as well. It is often used as a buy indicator for technical traders. Looking at the graph above, we can see that when the price surpasses the SMA line, the prices often trend upward for some time. To understand it better, let us look at the Amazon example again with the 10-day SMA line. They perform their analysis by looking at when the stock price line intersects the SMA line. Technical traders often use SMAs to time their buy and sell trades. Trading Strategies Using Simple Moving Average 1. It is once again because the 5-day SMA is a shorter period, which follows the price more closely, whereas the 10-day SMA considers more historical data. Using a 10-day SMA, we can calculate that at Day 10 (n=10), the 10-day SMA is $14.90. Using a 5-day SMA, we can calculate that at Day 10 (n=10), the 5-day SMA is $18.60. Suppose Company A posted the following closing stock prices: Day (n) It is just the average closing price of a security over the last “n” periods. Since the line represents an average of the previous 200 days’ closing prices, the line is a lot smoother and is not easily influenced by price fluctuations.

Since the SMA line was only calculated based on the previous 10 days’ stock price, the line follows price changes a lot more than the 50-day SMA shown in the previous chart.Ībove, a 200-day SMA was used. Even though Amazon reported amazing earnings that hiked its stock price to open at around $2,000, the SMA still stayed relatively similar and only increased by a little bit.Ībove, a 10-day SMA was used. The concept can be observed during the February 2020 earnings announcements. As described above, since SMA is an average of the prices over a specified time period, it does not react as drastically as the actual prices. The 50-day SMA is represented using the purple line, which indicates the overall trend of how the price is moving. The chart above shows how the price of Amazon’s stock (NASDAQ: AMZN) changed over a 1-year period using a 50-day SMA.

0 kommentar(er)

0 kommentar(er)